At a glance

Maximising efficiency in development and delivery is the foundation for sustainable patient access, greater affordability, and robust economic growth.

This report provides a comprehensive analysis of the UK cell and gene therapy sector, focusing keenly on the innovative technologies and strategic investments that are driving scale. It highlights how UK-based companies are actively addressing manufacturing bottlenecks through automation and digitalisation and how this focus on operational excellence will be key to unlocking future success.

We encourage policymakers, investors, and industry leaders to review these findings, ensuring we continue to provide the backing and supportive regulatory environment necessary to seize the unique opportunity ahead. The UK's future depends on it.

Executive summary

The UK cell and gene therapy (CGT) sector stands at a critical juncture, having translated world-class research into a robust, high-value industry now prioritising efficiency and scalable delivery to remain globally competitive. This report highlights key findings across investment trends, manufacturing advancements, and the UK’s strategic position in optimising cell and gene therapy delivery.

Key findings

Investment resilience and maturation

- Investment surge and stabilisation: The sector experienced a significant surge in total capital, peaking at £3.7 billion in 2021, mirroring global biotech trends. While subsequent years saw a necessary contraction, investment has stabilised at levels substantially above pre-2018 baselines, demonstrating sustained investor confidence in the sector's long-term fundamentals.

- Funding drivers: Venture capital remains foundational for early-stage growth, while the public markets have been essential for scale-up, notably through landmark Nasdaq and London IPOs (e.g., Oxford Nanopore, Adaptimmune).

- Ecosystem focus: Publicly financed companies are divided between therapeutic developers (advancing clinical pipelines) and platform/manufacturing companies (raising capital for capacity expansion and enabling technologies).

Manufacturing advancement and efficiency

- Shift to scale: The UK has successfully scaled manufacturing from small academic centres to large, purpose-built facilities, now employing over 2,000 staff in dedicated manufacturing roles.

- Focus on operational excellence: Given the high-cost, low-volume, and technically demanding nature of CGT production, the sector's next phase is focused on operational efficiency. Enabling technology providers (including Autolomous, Cellular Origins and Sartorius) and CDMOs (including eXmoor Pharma) are driving this forward through digitalisation, automation, and single-use technologies, aiming to reduce manual steps, accelerate QA release, and lower the cost per dose.

- Decentralised delivery: New MHRA guidelines on Decentralised Manufacturing position the UK as the first country to introduce a tailored framework for innovative products manufactured closer to the patient, addressing delivery challenges in underserved regions.

Strategic positioning and clinical momentum

- Global competitive advantage: The UK maintains a unique combination of world-class academic institutions, established infrastructure (reinforced by the CGT Catapult), and specialised talent. This ecosystem offers a competitive edge amid global geopolitical uncertainty, strengthening the case for the UK to serve as a trusted international hub for advanced therapies manufacturing.

- Robust clinical pipeline: Clinical trial activity remains strong, with early-stage Phase 1 and Phase 1/2 studies dominating the landscape. This stability reflects a continuously robust translational research environment and the ongoing advancement of assets toward late-stage development.

The big picture

Efficiency and global competitiveness

The UK has long stood at the forefront of cell and gene therapies. Particularly when it comes to research and innovation, UK-based companies have been internationally competitive, attracting significant investment.

This is unsurprising, given the country’s strengths. The UK has an experienced, skilled workforce with established facilities in strong regional clusters. It is home to four of the world’s top ten universities for life sciences and medicine, and ranks third for global medical sciences citations. These assets are reinforced by the Cell and Gene Therapy Catapult, which brings together academia, technology providers and therapy developers, accelerating the path from innovation to manufacturing.

Indeed, in recent years, UK cell and gene therapy manufacturing has scaled from small academic centres to large, purpose-built facilities, supplying both domestic and international markets, with over 2,000 staff in full-time manufacturing roles across the UK industry. Moreover, the UK is home to world-leading technology providers such as Autolomous and Cellular Origins, which have developed pioneering new technologies to drive efficiency in scaling cell and gene therapy manufacturing. Advanced therapies are low-volume, cost-intensive and technically demanding to make, with manufacturing remaining capacity-constrained, typically with small batch sizes and stringent standards. As such, the UK’s advantages in expert talent and specialised infrastructure lend potential for it to be the cell and gene therapies manufacturing centre for the world – a unique opportunity impossible for less complex modalities.

The shifting geopolitical picture has brought this opportunity into sharper focus. In April 2025, President Trump’s Executive Order 14257 launched a “reciprocal tariffs” regime, which added new duties across trading partners but carved out pharmaceuticals from those across-the-board measures. In parallel, the US Commerce Department opened a national-security investigation, creating a separate pathway for potential sector-specific tariffs. This geopolitical uncertainty will further drive strong international competition for investment into new medicines manufacturing facilities, which already intensified following the pandemic.

Amid this volatile and uncertain international backdrop, there are nonetheless good prospects for the UK’s sector. Crucially, these developments have reinforced why selective reshoring and friend-shoring – securing critical supply chains across a trusted network of ally nations – matters for UK competitiveness and national security.

But seizing this opportunity depends on efficiency, which is needed to keep costs and timelines down and maintain quality while scaling up production – all crucial for global competitiveness. This requires a pragmatic, future-oriented approach that leads adoption of the rapid advances in automation and digitalisation. By turning its existing strengths in talent and infrastructure into more efficient, scalable manufacturing systems, the UK can fully capitalise on its potential as a global manufacturing hub for the sector.

Landscape

Defining the UK cell and gene therapy landscape

The UK has emerged as one of the world’s most active and scientifically advanced centres for cell and gene therapy (CGT), supported by a distinctive combination of academic excellence, translational capability (as evidenced by Autolus Therapeutics' recent NICE approval for obe-cel) and specialised manufacturing infrastructure. Over the past decade, the sector has expanded significantly, with growing numbers of companies advancing novel therapeutic platforms, increasing clinical trial activity and sustained interest from domestic and international investors.

Alongside the investment patterns, this section highlights the companies driving scientific and clinical progress, the platforms and technologies emerging from the UK’s research base, and the investors whose long-term engagement has enabled much of this development. Together, these elements provide a clear picture of how the sector has matured, the momentum that continues to build, and the factors shaping the UK’s position within a globally competitive landscape.

Overview

Deal activity in the UK cell and gene therapy sector grew steadily from 2015 to 2019, reflecting increasing interest in emerging cell and gene therapeutic platforms. Overall, these trends closely mirror the investment cycles observed across the broader global cell and gene therapy sector. This growth accelerated during the pandemic peak, with total deal counts jumping to 93 in 2020 and 114 in 2021. Although activity reduced in 2022 and 2024, dealmaking remained higher than pre-2018 baselines. Capital investment patterns mirror these trends. The UK experienced a surge to £1.6 billion in 2020 and £3.7 billion in 2021. Post-peak, investment stabilised at levels significantly above pre-2018, demonstrating sustained investor confidence despite more selective conditions.

Venture capital (VC) continues to underpin early-stage growth in the UK CGT ecosystem. VC deal-making increased significantly between 2015 and 2021, rising from 15 to 50 deals. Investment totals also expanded, peaking at £1.2 billion in 2021. Domestic investors remain the foundation of UK CGT VC funding, with US participation expanding during peak years and contracting in alignment with global risk sentiment. European investor involvement remains modest but increasing.

Public markets

Public markets have been an essential, though cyclical, source of growth capital for UK cell and gene therapy companies, reflecting both the sector’s scientific strength and its exposure to global market conditions. UK CGT listings and follow-on raises climbed steadily from 2015 before reaching a high point in 2021, when public financing surpassed £1.2 billion across ten transactions.

IPOs

UK CGT companies have consistently looked to both London and overseas markets—especially Nasdaq—for scale-up capital. Landmark Nasdaq IPOs by Adaptimmune (2015) and Orchard Therapeutics (2018) secured, respectively, $191 million and $225 million, establishing a strong UK presence on US public markets. In parallel, London listings such as Oxford Nanopore’s £500 million+ IPO in 2021 provided a major domestic boost.

This 2018-2021 IPO window created a cohort of UK-origin CGT companies with regular access to public follow-on capital and underpinned the peak in sector fundraising.

Follow-on offerings

Follow-on offerings have accounted for a significant share of public financing since the IPO wave. Autolus, Adaptimmune and OXB completed multiple offerings, often raising £40-£280 million to support pivotal trials, manufacturing expansion and early commercial activities.

Follow-ons have additionally acted as recapitalisation tools for distressed issuers such as ReNeuron and TC BioPharm, highlighting the volatility of public markets for early-stage therapeutic developers.

Publicly financed UK CGT companies span two broad categories:

- Therapeutic developers – Autolus, Adaptimmune, Orchard and Freeline/Spur Therapeutics – raising capital to advance clinical pipelines.

- Platform and manufacturing companies – Oxford Nanopore, OXB, Horizon Discovery and 4basebio – raising funds for capacity expansion and platform investment.

While many have scaled successfully, others faced financial stress or restructuring, reflecting the capital-intensive and high-risk nature of CGT R&D.

Clinical trial activity

Clinical trial activity demonstrates the enduring scientific strength of the UK CGT sector. Phase 1 and Phase 1/2 studies dominate the landscape, reflecting the early-stage maturity profile consistent with global patterns. The stability of early-stage trials indicates ongoing innovation and a robust translational research environment, even as financing cycles fluctuate.

Autolus Therapeutics and Adaptimmune Therapeutics have progressed multiple engineered T-cell and T-cell receptor programmes through early human trials, supported by successive public financings that have enabled the advancement of assets such as Autolus’s obe-cel and Adaptimmune’s TCR-based oncology therapies toward later-stage development.

Orchard Therapeutics continues to play a major role in the gene therapy landscape, with autologous ex vivo programmes such as Libmeldy demonstrating successful progression from clinical development towards commercialisation. Spur Therapeutics contributes to early-stage activity through its liver-directed gene therapies.

The UK clinical ecosystem also includes companies developing novel vector, delivery and platform technologies that underpin trial activity. Akamis Bio is a notable contributor here, advancing systemically delivered tumour-specific adenoviral vectors designed to enhance immune-mediated tumour clearance. The company’s clinical-stage pipeline supports broader innovation in oncology-focused gene therapies and exemplifies the UK’s strength in developing platform technologies alongside therapeutic candidates.

Supporting capabilities are strengthened further by organisations such as OXB and Oxford Nanopore Technologies, which provide critical viral vector manufacturing, sequencing and analytical infrastructure, enabling the wider sector to advance candidates effectively into human studies.

Methodology and data

For this report, the BioIndustry Association (BIA) has collaborated with PitchBook to provide a granular and authoritative analysis of the UK cell and gene therapy (CGT) sector. Our data is curated using rigorous internal and external criteria to ensure accuracy and consistency.

Financing data methodology

All financing data (total capital, venture capital, and public funding) is sourced exclusively from PitchBook and covers the period from 2018 through Q3 2025.

- Scope: The analysis is strictly focused on UK-headquartered companies that meet the BIA's classification criteria for companies either developing, manufacturing or marketing cell and gene therapies, or companies developing or providing enabling technologies for those activities.

- Total capital: Total capital invested is segmented into two primary categories for granular assessment:

- Venture capital (VC): Includes all private equity, seed, angel, Series A-Z, and debt/equity deals.

- Public funding: Includes Initial Public Offerings (IPOs), secondary offerings, and private investment in public equity (PIPE) deals.

Clinical trial data methodology

Clinical trial data covers the period 2015–Q3 2025 and is based on a custom data pull from PitchBook.

- Scope and curation: The analysis exclusively includes UK-headquartered companies that meet the BIA's classification criteria for companies either developing, manufacturing or marketing cell and gene therapies, or companies developing or providing enabling technologies for those activities. All companies included have been manually curated by BIA.

- Filtering: Data is filtered using PitchBook's classification, which includes companies tagged with 'Gene Therapy Emerging Space' or 'Cell and Gene Therapy' or related keywords.

- Trial counts: Trial counts represent the total number of active trials registered within the calendar year, across all phases (Phase 1 to Phase 4).

- Geographic note: Consistent with the financing analysis, all data presented for Europe explicitly excludes the United Kingdom to maintain a distinct separation between the UK market and the rest of Europe.

Case studies

UK companies driving cell and gene therapy efficiency and innovation

Autolomous

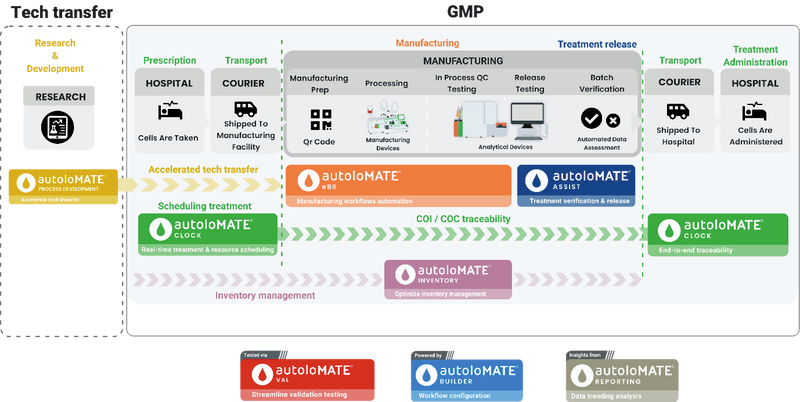

The manufacturing of cell and gene therapies remains one of the most resource-intensive, manual, and error-prone areas within the healthcare industry. A central challenge lies in the industry’s reliance on paper-based documentation and fragmented data systems, which historically slows down manufacturing, creates bottlenecks in QA review and increases the risk of human error. At Autolomous, our autoloMATE® platform addresses this problem directly by digitising and orchestrating end-to-end manufacturing workflows.

What does the company do?

Autolomous is the UK’s leading provider of an end-to-end advanced manufacturing management and digital platform that is purpose-built for cell and gene therapies. Our configurable, cloud-native system, autoloMATE®, offers the structure and connectivity needed to simplify processes, reducing manual steps and supporting compliance from the ground up. This conversion of manual workflows into a validated digital system enables manufacturers to scale production globally while maintaining GxP compliance and accelerating Quality Assurance (QA) release. The platform acts as the single source of truth for the entire manufacturing lifecycle, capturing every step, data point, and signature digitally.

By replacing inefficiency with digital precision, autoloMATE® empowers manufacturers to scale sustainably and deliver advanced therapies to patients faster and more reliably. Furthermore, the platform standardises complex processes, ensuring that the same therapy manufactured in the UK is produced with identical control and data capture across any multi-site or global network.

What is the impact?

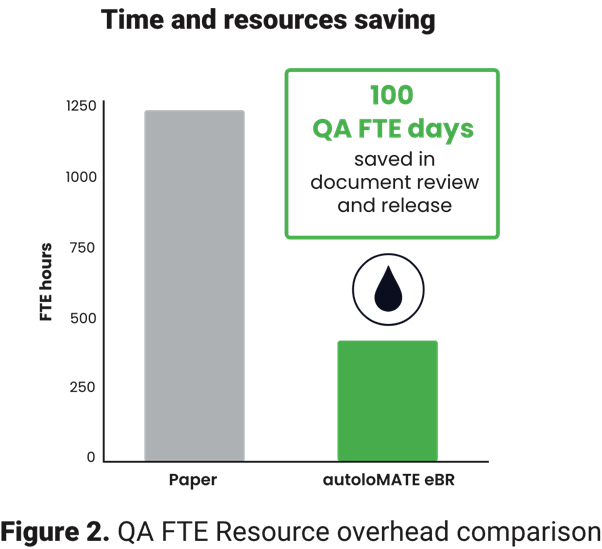

The quantifiable impact of Autolomous' solution is evident in real-world applications, directly addressing the time-consuming and complex quality release of advanced therapies. In collaboration with the CGT Catapult, sponsored by Innovate UK, the following were achieved:

- Accelerated QA release: Implementing the digital solution in an upstream AAV manufacturing process reduced the overall QA review time by 65%, saving approximately 100 FTE days and shortening time to approval by over three weeks.

- Complex batch efficiency: For a particularly complex batch records, the reduction in review and release time was even more dramatic, achieving an 86% reduction (from 225 hours to only 30.5 hours) by moving from paper batch records to eBR.

- Risk mitigation: The platform ensures complete data integrity through immutable data auditability, providing comprehensive audit logs and e-signatures that comply with regulatory standards and minimising risks associated with paper use in cleanrooms.

Why should investors invest in this space?

Investment in robust digital infrastructure is no longer optional; it is a mandate for commercial viability. Autolomous is positioned as a de-risking technology, providing the digital foundation that underpins successful regulatory filings and commercial scale-up. By solving the challenges of compliance, data traceability, and QA release efficiency, Autolomous ensures that capital invested into a promising therapy is not wasted on manufacturing delays or costly batch failures due to human error. Digital maturity directly translates into predictable commercial throughput.

Future trends for technology

The immediate future trend is the full integration of process automation with digital data orchestration. Autolomous is focused on empowering its partners – allowing them to drive predictive insights and AI-powered quality control. This will move the industry toward proactive, real-time quality management, where manufacturing systems automatically flag potential deviations before they compromise the batch, further cementing the UK's leadership in efficient, future-ready manufacturing technology.

eXmoor

eXmoor Pharma is the UK's only integrated CGT contract development and manufacturing organisation (CDMO), combining specialist consultancy and good manufacturing practice (GMP) manufacturing. The following case study details their unique model for de-risking development, accelerating time-to-clinic, and the long-term strategic partnership they have built with Quell Therapeutics.

What does the company do?

eXmoor Pharma is the UK's only integrated CGT CDMO with deep consultancy expertise embedded across the entire product lifecycle. Founded in 2004 as a specialist consultancy, eXmoor expanded its offering to meet evolving client demands, culminating in the 2024 opening of its purpose-built Cell and Gene Therapy Centre in Bristol. With a secured MHRA licence, eXmoor now provides full GMP clinical manufacturing alongside essential services like consultancy, process development, analytical services, and facility design. The company supports innovators across autologous and allogeneic cell therapies, viral vectors, and RNA technologies, positioning itself as a strategic partner rather than just a supplier.

How will it be used?

eXmoor's combined Consultancy and CDMO model addresses a critical inefficiency: the costly delays that occur when early development decisions are made without long-term manufacturing and regulatory strategy in mind. By engaging consultants at the earliest stages (often preclinical or spin-out), eXmoor ensures the Chemistry, Manufacturing, and Controls (CMC) strategy is robust, aligned with regulatory expectations, and scalable for commercialisation. This approach prevents clients from needing to rework processes at great expense later in the clinical pipeline.

What is the impact?

The long-standing partnership with Quell Therapeutics exemplifies the value of this integrated model. eXmoor's relationship with Quell's co-founder began over a decade ago by supporting the first regulatory T cell product into clinical trials. As Quell matured, eXmoor provided essential interim leadership roles, CMC strategy, QA consultancy, and Qualified Person (QP) services before becoming a strategic GMP manufacturing partner. This deep, sustained collaboration meant that when it came time to transfer Quell’s CAR-Treg programme into eXmoor’s facility, the process was significantly faster and more efficient, built on prior knowledge and mutual trust. This combination of early strategic guidance and subsequent GMP delivery significantly accelerated a complex cell therapy into clinical production.

What are the opportunities and challenges?

eXmoor's regulatory and quality expertise is central to its value proposition. The team has guided more than 170 organisations through process optimisation, GMP compliance, and facility qualification. Crucially, the in-house Qualified Persons (QPs) engage early to align CMC plans and development strategies with regulatory and patient safety requirements long before Clinical Trial Application (CTA) submissions. In the Quell collaboration, QPs with prior knowledge of the product portfolio supported CTA submissions, translating Investigational Medicinal Products Dossier requirements directly into GMP manufacturing and QC testing specifications. This collaborative, expert-led approach minimises risk, ensures technology transfers are transparent, and guarantees operational readiness.

Why should investors invest in this space?

eXmoor provides a model that de-risks development and accelerates time-to-clinic by eliminating the common disconnect between early-stage development and commercial-scale manufacturing. By providing integrated strategic consultancy alongside physical GMP capacity, eXmoor helps companies avoid common, costly setbacks, making the entire UK cell and gene therapy sector more attractive to investors looking for predictable scaling pathways.

Future trends for technology

eXmoor is continuously expanding its capabilities across autologous and allogeneic cell therapies, viral vectors, and RNA technologies. The core future trend is the ongoing integration of digital tools and data flow to further streamline the continuum from consultancy through to GMP manufacturing, driving greater efficiency and robustness for all clients as the sector matures.

Cellular Origins

Cellular Origins is focused on solving advanced therapies’ most critical challenge: achieving reliable, flexible, and scalable cell therapy manufacturing without compromising complex processes or increasing regulatory risk. The company positions itself in the global landscape as a key enabler and catalyst for scale, supporting the production of thousands to hundreds of thousands of doses per year for developers worldwide.

What does the company do?

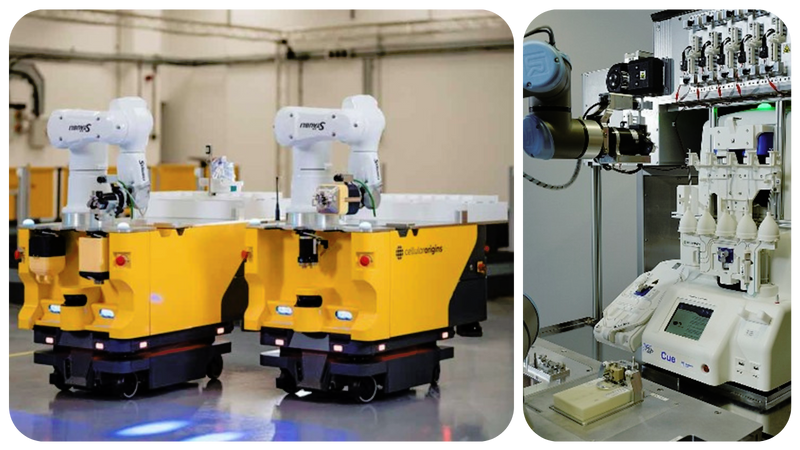

Cellular Origins' core business revolves around Constellation®, a modular robotic automation platform designed specifically for advanced therapy manufacturing. Unlike conventional semi-automated systems that force process re-engineering, Constellation is designed to adapt to and automate existing end-to-end cell therapy workflows. This process-agnostic approach is a fundamental shift, ensuring that processes validated at the bench can be scaled into clinical and commercial production swiftly, accelerating time-to-market and de-risking patient access. Building the platform relies on strong partnerships with leading technology providers and deep industry collaboration, ensuring seamless integration and reliability at scale.

Left: Cellular Origins’ Integrated Mobile Robots (IMRs); Right: Cellular Origins’ Constellation platform operating the Fresenius Kabi Cue

How does it address the manufacturing challenge?

Constellation addresses the challenge of scaling from clinical promise to commercial success without disrupting validated processes. It uses flexible mobile robotic automation to connect and orchestrate the instruments and workflows therapies already rely on. Mobile robotics provide adaptability and resilience, allowing the platform to intelligently route batches and tasks between instruments as workflows evolve. This is a crucial differentiator from static rail systems, which can create bottlenecks and single points of failure. This distributed, adaptive approach reduces risk by allowing rerouting around downtime and simplifies GMP compliance by standardising execution and preserving sterility.

What is the impact?

Implementation of the Constellation platform delivers tangible, quantifiable efficiencies essential for commercialisation:

- Labour reduction: 24/7 ‘lights-out’ operations cut labour requirements by up to 16 times, allowing throughput to increase significantly without growing team size.

- Cost and space efficiency: The compact, mobile design enables a greater than 30 times space optimisation and can reduce the Cost of Goods (CoGs) by as much as 51%.

- Case example (CGT Catapult): A landmark installation at the CGT Catapult’s Stevenage Manufacturing Innovation Centre demonstrated that a highly manual process could be run robotically within months, preserving sterility while dramatically reducing operator input. This and further upgrades and testing are providing robust proof that automation can produce therapies at volumes not previously achievable, without altering the underlying therapy.

What are the opportunities and challenges?

The primary challenge remains the capital investment and technology transfer required for industrial scale-up. Cellular Origins addresses this by providing an immediate, integrated path to scalability. Their technology provides both physical and digital automation, connecting instruments from different companies into a digital system for orchestration and data capture. This enables rapid and reliable technology transfer: a process proven in Cambridge, UK, can be replicated exactly in Boston, Singapore or Berlin because every robotic action is traceable and repeatable, simplifying global compliance.

Why should investors invest in this space?

Investment in manufacturing automation technologies like Constellation is essential for de-risking the commercial viability of the entire cell and gene therapies sector. By applying proven, industry-leading principles (like mobile robotics used in automotive and semiconductor manufacturing) to cell and gene therapy, Cellular Origins brings the reliability and future-readiness that the UK ecosystem needs to achieve its potential. The UK’s commitment to innovation in this space is further evidenced by a newly awarded £1 million Smart Grant from InnovateUK to expand the platform's function and capabilities.

Left: Cellular Origins’ Constellation platform operating the Cytiva Sefia Select System; Right: Cellular Origins’ Constellation platform at the Cell and Gene Therapy Catapult Digital and Automation Testbeds, Stevenage

Future trends for technology

The future trend is a shift towards truly connected digital manufacturing. Cellular Origins' platform forms the foundation of this ecosystem, enabling process-to-process standardisation and real-time data capture. Future development, supported by the Innovate UK grant, will focus on expanding the platform to connect and automate more GMP processes and unit operations, further simplifying quality, regulatory reporting, and interoperability with broader digital enterprise systems.

Sartorius

Sartorius supports the development and production of biopharmaceuticals across a broad spectrum of modalities, from traditional monoclonal antibodies (mAbs) to advanced therapies, including cell and gene therapies (CGT) and RNA. The company operates as a strategic partner, offering an end-to-end portfolio that integrates upstream, downstream, analytics, and digital solutions. Recognising the specialised needs of the nascent CGT sector, Sartorius has established a dedicated Advanced Therapies Department.

What does the company do?

Sartorius leverages critical acquisitions, such as CellGenix® (Preclinical and GMP cytokines and cell culture media), Biological Industries (Preclinical and GMP media and cryopreservation media), Albumedix (recombinant albumin), and Polyplus® (transfection reagents, lipid formulations for non-viral delivery and plasmid design), to provide critical raw materials to the advanced therapies market. Crucially, the company supports advanced therapy developers with its product portfolio and deep technical expertise. This partnership approach is essential in the younger CGT market, where processes require more optimisation and exploration than mature mAb production. This specialised support helps emerging companies navigate process development, scale-up, and regulatory compliance.

How does it enable scale and consistency?

Sartorius provides fully scalable solutions designed to maintain consistent, high product quality during scale-up:

- Bioreactors: The single-use Biostat STR® platform offers scalability from millilitre-scale development up to 2,000 litres. Its consistent engineering across scales maintains optimal mixing dynamics for reproducibility, while the single-use nature eliminates the need for time-consuming cleaning and sterilisation validation between batches. Real-time quality monitoring is achieved through the integrated BioPAT® software.

- Filtration: The Hydrosart® and Sartopore® families of filtration consumables are engineered for high throughput and low product loss. They feature a modular design, allowing manufacturers to tailor the surface area and configuration to the specific characteristics of their feed, ensuring scalable performance across variable processes.

What is the impact?

Sartorius is leveraging UK expertise to develop next-generation manufacturing solutions. A key collaboration with University College London (UCL) is centred on developing a fully automated, closed manufacturing platform for cell therapy utilising our advanced therapy raw materials. The product is being developed at Sartorius' Royston, UK site, utilising the local expertise of its Automation Partnership team.

This automated approach aims to address the high Cost of Goods (CoGs), high staffing requirements, high capital deployment for production sites, and process variability:

- Process efficiency: The fully automated system reduces the overall cell therapy process time by several days, significantly accelerating vein-to-vein time

- Cost reduction: Data from the collaboration demonstrates a 45% reduction in CoGs. Monte Carlo simulations indicate the potential to reduce the cost per patient dose to as low as $21,000, representing a massive savings and shifting the cost bottleneck away from labour and manufacturing footprint.

- UK expertise: The fact that the physical manufacturing, cell culture, and mechanical integration are all happening in the UK, in collaboration with a globally recognised academic hub like UCL, underscores the UK's vital role in advanced therapy innovation.

Opportunities and challenges

The primary bottleneck in CGT development is not a lack of excellent physical technology, but the difficulty of process optimisation and regulatory compliance. Sartorius addresses this by providing extensive technical and digital support beyond hardware. This includes:

- Digital analytics: Providing access to Design of Experiments (DOE) software, such as MODDE®, which allows customers to rapidly identify optimal conditions for yield and quality without extensive physical experimentation.

- Regulatory guidance: Offering expert support in GMP manufacturing environments, including guidance on validation, documentation, risk mitigation, and viral clearance. This expertise is crucial for strengthening the Chemistry, Manufacturing and Controls (CMC) packages often cited by regulators (FDA/MHRA) as lacking, thereby improving the likelihood of therapy approval.

Future trends for technology

Sartorius' strategy is moving toward deep customer-centric development and digital enablement. By involving partners like UCL at the prototype stage, they capture the 'voice of the customer' to ensure new products deliver tangible benefits. We offer a consultative approach to help customers overcome process hurdles, ensuring that technology, expertise, and compliance efforts are fully integrated to efficiently bring therapies to patients globally.

Opportunities and challenges

Optimising cell and gene therapy delivery

Manufacturing scalability and efficiency

Challenges and opportunities in scaling manufacturing and improving efficiency

The high variability of cell types, gene-editing techniques and manufacturing sites makes streamlined production of cell and gene therapies challenging. The need for bespoke processes and equipment limits opportunities for scale, drives up cost and makes it harder to automate. Moreover, delivering cell and gene therapies to patients in underserved regions is hindered by prohibitive costs and insufficient specialised infrastructure. These pressures will likely only compound when advanced treatments are developed for more common diseases with larger patient populations. As such, efficiency is critical to scaling manufacturing because it lowers cost per unit, removes bottlenecks and maintains quality – all of which determine whether the UK can compete as a global manufacturing hub. Reliable and scalable methods for preserving, transporting and delivering are thus vital to success. The case studies presented in this report show how the UK sector is driving this forward:

- eXmoor Pharma couples early expert guidance with in-house GMP manufacturing – helping Quell Therapeutics move a complex cell therapy into clinical production faster and with fewer risks.

- Cellular Origins’ modular robotic platform can reduce staffing needs by up to 16 times and save space by more than 30 times.

- Sartorius’ single-use Biostat STR eliminates cleaning and sterilisation validation between batches.

- Autolomous’s autoloMATE platform digitises workflows, accelerating batch release and boosting throughput without increasing headcount or footprint.

Meanwhile, new MHRA guidelines on Decentralised Manufacturing, which took effect in July 2025, are a step in the right direction. They made the UK the first country in the world to introduce a tailored framework for innovative products manufactured at or close to where a patient receives care, helping address some of the challenges associated with delivering cell and gene therapies to less populous or remote regions.

Regulatory and reimbursement efficiencies

Challenges in navigating regulatory and reimbursement pathways

Cell and gene therapies present unique challenges as they move through regulatory and reimbursement pathways due to their complexity, novelty and high cost. If the UK can find new ways to address these, it will enable companies to deliver cell and gene therapies to patients quickly and more efficiently.

Regulatory agencies often require extensive evidence of long-term safety and efficacy, which can be difficult to generate for one-time or individualised treatments. In the UK, the MHRA is well-placed to respond to this challenge by ensuring risk-proportionate regulation which drives innovation and accelerates access to new technologies. The MHRA’s plans to reform the regulatory rulebook for rare diseases signal a clear intent to establish the UK as a global leader in developing, regulating and adopting advanced therapies for rare diseases.

On the reimbursement side, there are challenges associated with assessing value and affordability, especially for curative therapies with high upfront costs but uncertain long-term outcomes. However, it is clear that the adoption of cell and gene therapies can bring enormous benefits to patients, families, healthcare systems and the economy. Analysis by the Cell and Gene Therapy Catapult and Office for Health Economics has found that wider adoption of advanced therapies in the UK in just four indications could unlock health benefits exceeding £20 billion over 10 years.

It also sets out a methodology for assessing the value of a medical intervention to society as a whole, which could be used alongside standard health technology assessment (HTA) health benefit calculations that currently do not capture these wider macroeconomic effects. There is an opportunity for the UK’s HTA body, NICE, to pioneer the development and integration of these new methodologies in order to ensure that the full value of innovative therapies is recognised.

Talent and skills for efficient cell and gene therapy

Address the skills gap and strategies for training a workforce in efficient cell and gene therapy manufacturing and delivery

The UK’s cell and gene therapy sector has created thousands of high-value, well-paid jobs, which will have wide positive economic spillovers and anchor advanced therapies manufacturing in the UK. Indeed, the sector’s workforce (R&D and manufacturing) has already doubled from 3,033 in 2019 to 6,232 in 2023 and is projected to exceed 10,000 by 2028.

However, to capitalise on this and sustain the sector’s rapid growth, the skills pipeline must keep pace. There are several promising programmes in place to address the challenge, including the RESLIENCE UK Medicines Manufacturing Skills Centre of Excellence, funded by the Government Office for Life Sciences, which is providing training, mentoring and outreach.

Opportunities and challenges around scaleups and investment

Opportunities and challenges around scaleups and investment

The UK’s life science start-ups and scale-ups are internationally competitive, drawing roughly 40% of Europe’s biotech venture funding. UK biotech raised £924 million in Q1 2025, driven by a handful of megadeals, and reached £1.23 billion by H1 – almost matching the whole of 2023 – underscoring investor belief in the sector’s fundamentals. However, Q3 2025 VC fell to £187 million, reflecting a fragile market and a continued shortage of domestic late-stage capital. Many larger rounds and listings are also dependent on overseas investors and markets, reducing the incentive for companies to scale and stay in the UK.

So far in 2025, UK cell and gene therapies have raised £0.3 billion in total capital across 28 deals – a decrease from previous years. But this is not a problem confined to the UK. Indeed, global investment in cell and gene therapies has fallen substantially since 2021, as part of a broader downturn in investment in the biotech sector.

UK pension funds are well-placed to ameliorate this challenge via increasing their exposure to late-stage VC funds and growth-stage public market deals. However, since pension reforms may take several years to translate into the scale of investment the sector needs, public financial institutions – such as the British Business Bank, National Wealth Fund and Innovate UK – remain vital sources of capital for companies currently trying to scale in the UK.

Our role

BIA's role in driving cell and gene therapy efficiency

The BIA has provided vital support to the UK cell and gene therapy sector through its expert Cell and Gene Therapy Advisory Committee, which helped shape this report. The committee brings together much of the UK industry – more than 40 companies spanning biotech, pharma, investors and lawyers – alongside key organisations such as the Cell and Gene Therapy Catapult and Innovate UK. The BIA’s Cell and Gene Therapy Community also convenes a larger group of BIA members working in the advanced therapies space, helping to share expertise and create opportunities to collaborate.

The BIA’s Manufacturing Advisory Committee convenes leading experts from across the UK’s biologics and cell and gene therapy manufacturing sector. Alongside the Cell and Gene Therapy Advisory Committee, it plays a critical role in supporting the BIA’s policy work, driving innovation, and promoting best practice to reinforce the UK’s position as a global leader in life sciences manufacturing. The Manufacturing Advisory Committee’s Leadership Programme (LeaP) develops emerging leaders in cell and gene therapies and biomanufacturing through cross-sector learning, peer networking and mentoring, with small cohorts featuring regular site visits, seminars and a group project.

Working with stakeholders across the ecosystem, the BIA promotes and supports the UK cell and gene therapy sector through several key avenues discussed below.

Advocacy and policy

The BIA engages closely with policymakers and stakeholders on topics of importance for UK cell and gene therapy, including regulation, patient access, and access to finance.

For example, we are working with the MHRA to ensure risk-proportionate regulation that accelerates innovation while safeguarding patients, including through our participation in the MHRA’s Rare Disease Consortium – a forum shaping plans to develop tailored pathways for innovative rare disease therapies. We are also advocating for changes to the access and reimbursement system to ensure timely and equitable patient access to new cell and gene therapies, including by recognising the full value of cutting-edge medicines to patients, families, carers and the UK economy.

Improving access to finance for scaling biotech companies is another priority area for the BIA’s advocacy work that will directly strengthen the cell and gene therapy sector by supporting the pipeline of companies in development. BIA played a key role in securing the Mansion House Accord in May 2025 and urges the government to keep up pressure on pension providers to commit capital to UK life sciences – moving to mandatory allocations if voluntary progress remains insufficient.

The BIA has also pushed for the expansion of the British Business Bank and its Direct Investments team (formerly British Patient Capital)—a cornerstone of the UK venture ecosystem—to enable rapid deployment of new capital. The extra funding announced through the Industrial Strategy and Spending Review is welcome. Given that life sciences face the UK’s largest scale-up funding gap versus the US, the BIA recommends directing the bulk of support to this sector. We have also called for prioritisation of the British Business Bank’s planned British Growth Partnership, a state-backed vehicle to channel pension and other institutional investment into life sciences and technology companies within the British Business Bank portfolio.

Specifically to promote investment in manufacturing, the £520 million Life Science Innovative Manufacturing Fund makes the UK more internationally competitive by contributing up to 25% of total project costs. The BIA have called for the full programme to be rolled out quickly and made available for small, medium and large companies to support the whole ecosystem and nurture a diverse manufacturing base; crucially, grants must be tailored to SMEs’ specific needs, which have historically been neglected. The new £29 billion National Wealth Fund also has a mandate to support life sciences by investing in real assets, which include cell and gene therapy manufacturing facilities, where there is strong commercial potential.

Collaboration and partnerships

BIA works closely with stakeholders across the ecosystem to support the growth of the UK cell and gene therapy sector. In 2016, the BIA supported an Advanced Therapies Manufacturing Taskforce task and finish group through the Medicines Manufacturing Industry Partnership (MMIP), focused on establishing cell and gene therapy manufacturing in the UK. The Advanced Therapies Manufacturing Taskforce’s recommendations helped to secure £146 million of Industrial Strategy Challenge Fund support for medicines manufacturing.

The BIA is also part of the Industry Advisory Group for the UK Advanced Therapy Treatment Centres Network, a nationwide, NHS-embedded programme – coordinated by the Cell and Gene Therapy Catapult and supported by Innovate UK – which aims to make the UK the leading environment for cell and gene therapy clinical trials.

Supporting manufacturing innovation

The BIA runs the annual bioProcessUK conference, which serves as the UK’s flagship gathering for the bioprocessing community, bringing together industry, academia, regulators and suppliers for technical sessions and networking. The conference provides an opportunity to highlight new innovations in UK manufacturing and support ongoing collaboration.

As a member of the MMIP, the BIA also collaborates with the ABPI, Innovate UK and the Office for Life Sciences. Formed in 2014 through a joint government–industry initiative, the MMIP’s purpose is to keep the UK at the forefront of cutting-edge medicines manufacturing globally. We will continue to drive initiatives with other stakeholders to help foster manufacturing innovation in the UK.

Conclusion

The future of cell and gene therapy in the UK

In the UK, cell and gene therapies remain attractive to both domestic and overseas venture investors, with a vibrant ecosystem benefitting from world-class universities, a skilled workforce, and robust infrastructure. However, there is scope to significantly strengthen the sector, to ensure it does not fall behind other modalities and remains internationally competitive amid growing geopolitical volatility.

As the evidence in our report demonstrates, the sector has progressed rapidly in various ways and is increasingly effective at achieving manufacturing efficiencies and scaling up. This will be vital as more advanced therapies are developed and approved for different conditions.

The BIA has collaborated with industry and other stakeholders in the ecosystem to help drive several crucial initiatives and will keep partnering with members to keep the UK ahead in this rapidly evolving field.