Executive summary

The UK is a global life sciences leader. Yet unlocking UK biotech’s full potential requires a shift in mindset. A lack of commercial ambition, plus lingering suspicion within academia and the National Health Service (NHS) of industry’s profit-motive, have contributed to others’ reaping much of the economic reward from our country’s extraordinary innovations.

For too long, we have celebrated the blossoming of academic papers or chased NHS savings yet neglected to ensure our technologies grow industrial roots in the UK. We have thereby denied ourselves the full benefits that ensue from companies, businesses and scaling-up.

The UK needs to grow its biotech companies to boost nationwide economic expansion and health outcomes. We must embrace their commercial success as core to UK growth, rather than shy away from making money in healthcare and net zero.

In 2035, we envision a UK biotech sector with a stronger long-term capital base supporting both early—and later-stage firms. It will include more scaled-up companies, more hospitable public markets, a deeper talent pool, and continued global recognition for leadership across research, health/genomics data, clinical infrastructure, and specialist manufacturing. UK biotech will have shored up its status as a top three cluster internationally.

To make Vision 2035 a reality, we, as a sector, must focus on areas that will have the greatest impact. Attracting and unlocking late-stage capital to build bigger, more valuable companies should be a priority. Pension reform is part of that; so is drawing US and international funds to the UK. We will accelerate ongoing efforts on both those fronts. A broader, longer-term capital base will help draw more skilled individuals to the UK; we will also encourage specific measures to nurture our homegrown skills base and attract international talent.

Shoring up the UK’s international standing requires us to double down on our strengths. We will leverage UK biotech’s unique advantages – including burgeoning AI-powered techbio innovation, a modernising NHS and globally recognised regulatory expertise – to bolster our reputation within the international life science ecosystem.

Thinking bigger and bolder, focusing on this reform agenda and continuing to deliver value for our current capital base will ultimately foster friendlier local capital markets. The Hong Kong and Shanghai exchanges show how fast local markets can emerge and pivot to focus on domestic life sciences businesses.

UK biotech already stands on the global podium – a hard-fought and deserved accolade. We have come a long way in the last decade: the amount of venture capital going into UK biotech almost trebled between 2015 and 2023. But the global race for prominence and dominance within this economy of the future is intense. Many other countries and regions want well-paid, highly innovative green jobs and skills bases in their area.

By focusing on a few core areas, continuing to improve what we already do well, believing in ourselves and the economic and moral value of economic growth, we will create an even stronger, faster-growing and more resilient sector better placed to deliver breakthroughs for people and patients at home and across the globe.

BIA Parliament Day 2016 and 2023

How did we do on Vision 2025?

In 2015, the BioIndustry Association (BIA) published a ten-year vision for the UK biotech sector. We aimed to build Europe’s leading biotech hub, with globally competitive support services and a thriving commercial eco-system, from start-up to large-cap, including a strong tier of midsized companies close to commercialisation.

Sir Patrick Vallance at BIA Gala Dinner 2025 (left); Steve Bates & George Freeman at BIA Gala Dinner 2022 (right)

We achieved many of our aims:

- Delivering for society when it mattered most

During the 2020-2021 pandemic, we delivered COVID-19 vaccines and other products that showed the British public and the world how a deep scientific understanding of a novel threat, combined with an entrepreneurial, move-fast mindset, can make a real difference to lives and livelihoods. The sector very directly proved its worth to society through the work of the UK Vaccine Taskforce. This achievement is fading in the collective memory but demonstrated what is possible.

- Growing venture capital (VC) investment

In 2024, UK biotech attracted £2.24 billion in VC funding, up 337% from 2017, according to the BIA biotech financing report 2024.

- Starting more companies than any other country in Europe

In 2023, more UK-headquartered companies raised Series A rounds than those in any other country other than the US, according to Citeline. Life sciences VC has shown potential for faster-realised returns (DPI) compared to the overall market, though longer development timelines impact overall returns (TVPI), according to the British Business Bank.

- Expanding the UK’s (already out-sized) contribution to biomedical literature

We extended our lead over rival US clusters in the number of published biomedical papers – though China’s extraordinary growth now outpaces that of the US, UK and most European countries.

- Attracting continued investment from key global players. For example, AstraZeneca located its HQ to Cambridge, UK in 2013 and remaining an independent company in 2014.

The burgeoning Kings Cross “Knowledge Quarter” attracted GlaxoSmithKline’s AI research hub in 2020 and AstraZeneca’s new UK commercial headquarters in 2022, whilst Merck MSD broke ground on its UK headquarters in the area last November. Shortly after, Eli Lilly & Company announced plans to open its first ex-US “Gateway Labs” innovation accelerator in the UK, which will provide lab space and support to biotech entrepreneurs. Novo Nordisk and UCB invested in UK research centres in Oxford and Windlesham, respectively, while AstraZeneca continued to expand its Cambridge footprint.

BIA Gala Dinner 2025

But we fell short on one key goal: scaling-up

Critically, the eco-system failed to support later-stage companies. Our 2015 Vision anticipated one hundred more listed pre-commercial stage biotechs and medtech firms in the UK than exist today.

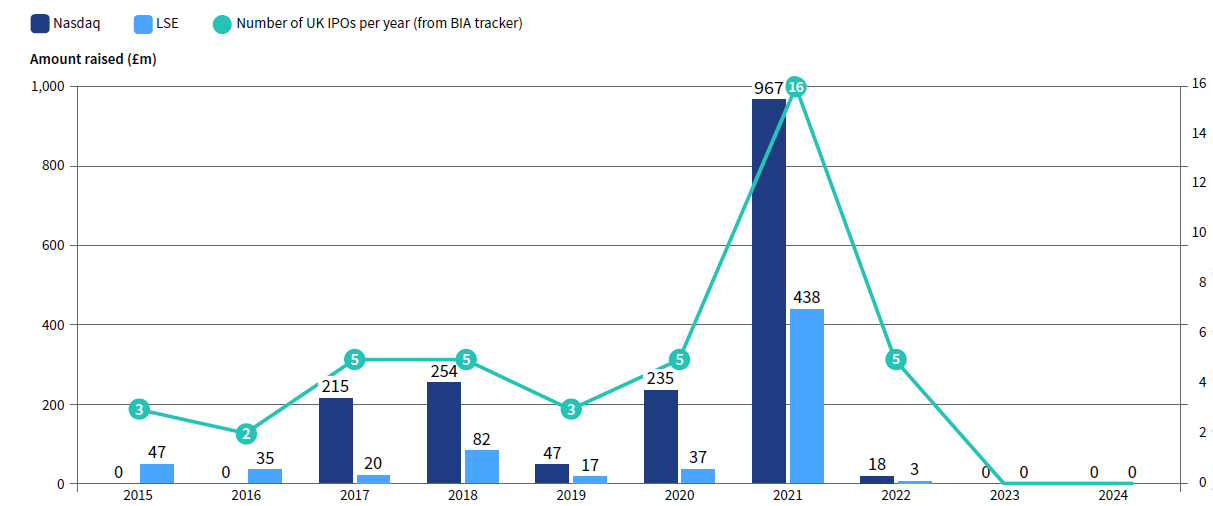

UK-based pre-revenue biotechs, sorely lacking long-term capital support and a viable local public market, were forced to pursue US listings. Nasdaq IPOs have today become the norm: Bicycle Therapeutics, Immunocore, Autolus Therapeutics, Centessa Pharmaceuticals and Vaccitech (now Barinthus Biotherapeutics) were among UK biotech’s exports before the global biotech IPO market closed in 2022. Redx was de-listed from AIM in 2024 due to a lack of coverage on London’s junior market.

Amount raised in UK biotech Initial Public Offerings (IPOs) since 2015

The weakness across our later-stage and public biotech eco-system means that followon financings, job creation, average wages and the total salary pool have all grown more slowly than anticipated, according to EY.

It has also generated an even wider financing gap with the US, now estimated at more than $3 billion annually (normalised to GDP). The GDP-adjusted US-UK venture funding gap is wider for biotech than any other sector, according to the British Business Bank.

In 2023, Massachusetts, Northern and Southern California each raised more private and public biotech equity than the UK, although we still hold our own versus other European clusters.

This failure to provide adequate late-stage and growth capital in the UK drives our 2035 Vision.

Unless we address this problem, the fruits of our research and innovation will continue to flow to the US and other nations. UK exports have grown significantly less since 2015 than those of other countries. The number of revenue-generating UK-based life sciences firms has also fallen in the last five years, according to Pitchbook data. The demise of Neil Woodford’s Equity Income Fund in 2019, which had stakes in several UK biotechs, arguably came about in part due to inadequate local listing options and shook investor confidence further still.

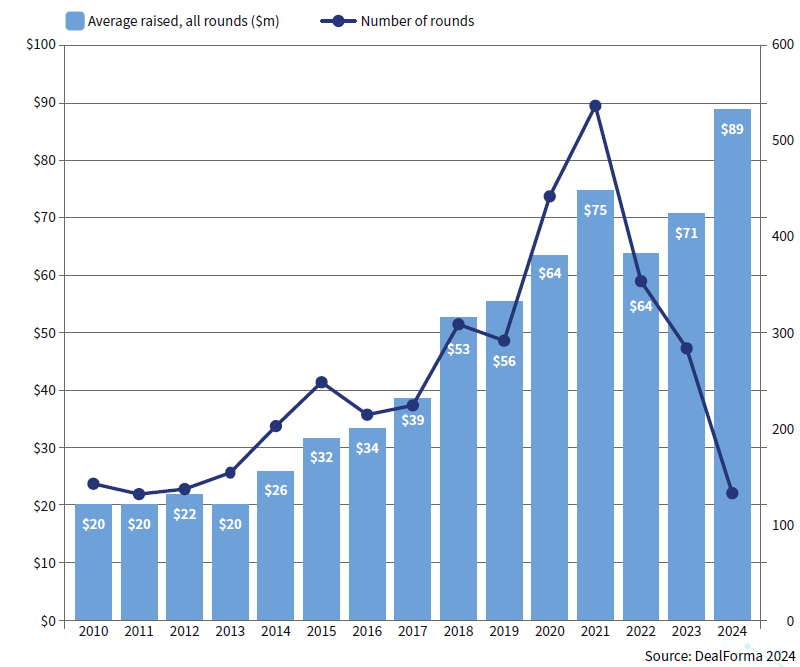

The capital problem may be further exacerbated by private investor dynamics. Across the sector, average biotech funding rounds are getting bigger, in part due to ballooning VC fund sizes. Private investors are financing companies for longer, often with an IPO in mind. Many will encourage those firms to build a stronger presence, sooner, in their place of IPO to attract crossover and public investors required to support a listing. This may result in UK-founded companies up-rooting even earlier.

Losing our most ambitious small and midsized companies to the US threatens our flourishing start-up eco-system and removes a key growth engine for UK plc: innovationpowered firms that are most likely to grow into large, listed companies providing employment and tax revenues.

A/B/C/D averages – biopharma therapeutics and platforms

Woodford Fund demise highlights – and worsens – UK capital problem

While the demise of Woodford Fund Management in 2019 serves as a cautionary tale, it should not overshadow the inherent potential of the UK life sciences sector. Woodford’s strategy of investing in a broad range of early-stage UK life science companies, was predicated on a sound understanding of the sector’s long-term growth prospects. Whilst the saga gave some in the City of London a lazy narrative to shun biotech, data demonstrates strong realised returns in venture capital investment in UK life sciences companies.

UK biotech faced three significant shocks during the decade to 2025

UK biotech faced three significant shocks during the last decade: Brexit, the pandemic, and the collapse of Silicon Valley Bank (SVB). It survived the first, thrived during the second and successfully managed the third. UK biotech responded to the COVID-19 outbreak with extraordinary speed, innovation and agility. Our genomics experts led the world in sequencing the virus and understanding its genetic variance patterns. Scientists developed a vaccine that changed the course of the disease globally; our NHS and national clinical trial infrastructure enabled record-breaking vaccine roll-out and rapid testing of new and existing COVID-19 therapies.

As for the SVB crisis, it was mercifully short-lived and left little damage, thanks to the exquisitely networked UK biotech community, with help from the BIA.

Brexit undermined the UK MHRA’s central role in European medicines regulation, as EMEA shifted its headquarters to Amsterdam. Britain’s exclusion from the Horizon programme broke vital ties with EU and international researchers. European Investment Bank funds became inaccessible to UKbased scientists and entrepreneurs. More cumbersome immigration rules discouraged European scientists from studying and working in the UK, while import/export tariffs hit UK companies across all sectors.

Yet UK biotech navigated the Brexit shockwaves to maintain its top three global cluster status. We leveraged our agility and networks to share bestpractice and minimise Brexit’s impact on R&D and commercial activities. The UK has since re-joined Horizon Europe and the related Copernicus Earth Sciences program, and the MHRA has nimbly aligned with other regulatory agencies.

Life Science Leadership Summit 2021 and 2024

Vision 2035

UK life sciences’ ambition for the next decade

UK life sciences’ Vision 2035 is to create a stronger, world-leading sector that contributes more directly to better health outcomes and to the UK’s net zero environmental objective. By 2035, the sector will be underpinned by a healthy early- and latestage funding ecosystem, with at least half a dozen scaled-up companies, an expanded skills base and extensive collaboration with academia, the government and the NHS.

Achieving this Vision requires us to focus on four key goals:

Unlock late-stage capital and accelerate pension reform

Unlock late-stage capital and accelerate pension reform

Unlocking late-stage capital, including from UK pension funds, which remain woefully under-invested in innovative growth firms, including across life sciences

Over the next decade, the priority for our sector will be to boost the availability of later-stage and long-term capital to support scaling UK companies for longer, encouraging more to stay in the UK.

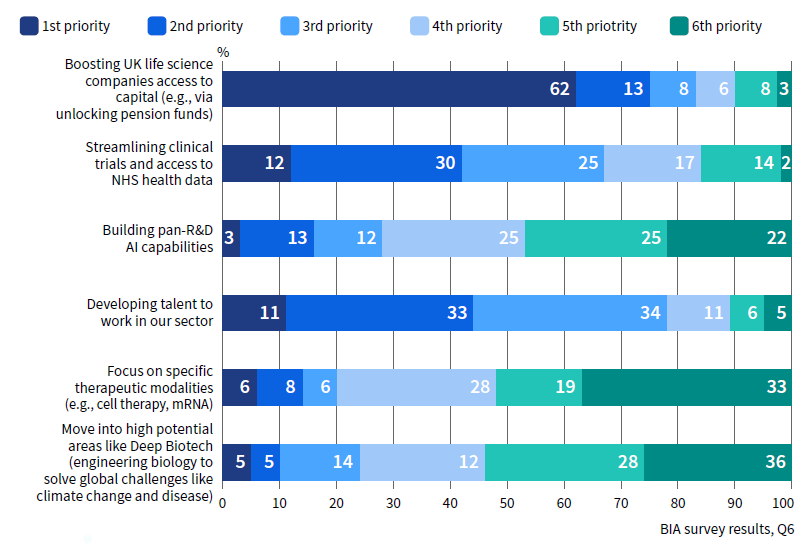

Accelerating pension reform is part of the solution. Innovative procurement regimes and novel industrial strategic partnerships can also provide vital revenue for scaling businesses. In a survey carried out during the summer of 2024, BIA members clearly identified access to pension funds as key to supporting continued UK biotech industry growth.

Currently, only about 5% of all UK pension fund assets, or about £150 billion, is invested in UK equities, according to the Pensions Policy Institute, down from over 30% twenty years ago.

Where should the UK biotech industry focus its efforts in the next 10 years to achieve your top goal?

The pension industry is coming on board. There is real appetite. But it will be an evolution, not a revolution.

The Mansion House Compact and allied initiatives, though welcome, do not go far – or fast- enough. UK biotech alone could productively absorb at least an additional $2 billion each year. Even a small increase in pension fund allocation to high-growth UK assets – from less than 5% to 8%, for example – would have an outsized impact on the life sciences sector, driving better returns for pension holders and boosting the UK economy in a positive feedback loop.

Achieving this requires putting in place the right structures for UK pension fund managers to access life sciences expertise.

Attracting more pensions capital to life sciences also means correcting perceptions of how risky life sciences investments are. Currently, institutional investors “see more risk and higher failure rates in life sciences than in tech or deep tech,” said Louis Taylor, CEO of the British Business Bank at the Jefferies Healthcare conference during London Life Sciences Week. “The reality is the inverse.” Specialist investors such as Tim Haines, Managing Director at venture capital firm Abingworth, acknowledge that there is more to do. “There’s no question that we [biotech VCs] have not communicated our [investment] performance well or loudly enough.”

Showcasing this performance will help overcome inherent conservatism and inertia in the pensions sector. It may also shift pension fund managers’ – and consumers’ – focus away from minimising fees, toward maximising returns. The best-managed Canadian and Australian pension plans return 10%, notes Kate Bingham, Managing Partner at SV Health Investors. “Our industry, in contrast, is a race to the bottom on fees” with more muted returns as a result.

UK biotech investments perform at least as well, if not better, than those in the US. We’re more efficient, more productive [in generating early safety and efficacy data] and teams are stickier.

Supporting and expanding these pension policy investment initiatives – including through greater communication of riskreturn data – will also help draw further foreign capital to UK life sciences. US biotech investors are already drawn to the thriving TechBio hub at King’s Cross, for example, where deep-pocketed venture capitalists including Flagship Pioneering, Orbimed and Sofinnova have footprints.

We must also shift mindsets, in two ways.

First, we must embrace and articulate the profit motive at home. Money-making and a growing industry can, and should, sit alongside our thriving academic research. The two drive each other. Publications are important, but profit matters too. We must do more to monetise crown jewel resources such as the UK Biobank (which, for the last decade has generated patents only for non- UK organisations.) We owe it to our society and the UK economy to extract more of the value from what we discover and build at home.

The UK is one of the most interesting and investable biotech markets in Europe.

Second, we must be louder and bolder in marketing UK biotech abroad: investors who hear about UK strengths are more likely to put their money to work here.

More capital, more scaled-up companies and a more confident embrace of the profitmotive should catalyse some break-out successes, which will in turn draw further investment and talent.

We need some really big UK successes that provide healthy investor returns. Then others will follow and the flywheel will start to spin.

Expand homegrown skills and attract more international talent

Expand homegrown skills and attract more international talent

Building homegrown talent through greater sector awareness and more tailored educational programs, and attracting overseas experts to the UK

Building bigger biotech companies takes people, as well as capital. The broader UK life sciences sector – including biotech, pharma, medtech, services and supply firms – already employ over 300,000 highly skilled individuals across R&D, regulatory, legal and finance.

UK biotech CEO salaries now match those of Boston leaders, according to Thelander Consulting. Employment across medical technology and services and supply firms has risen steadily over the last decade, according to government figures. But the number of employees across biotech and pharma has remained static, at about 70,000.

A Skills England report published in September 2024, warns of potential skills shortages that could impede future growth of this £108+ billion sector. The report highlights gaps across specialist science and research, digital and data skills, medicines manufacturing, and translation/ commercialisation, emphasising the need for targeted interventions.

With ever-greater global competition for talent, we must be more proactive in nurturing homegrown life sciences expertise and attracting UK and international experts from abroad. Education programs must be better tailored to current and future skills requirements, and access made easier for international professionals.

UK life sciences has benefited, over the last few decades, from local Big Pharmaand City-of-London-trained talent. This remains important. But as Big Pharma’s R&D footprint shrinks, relying on pharma as a talent academy will be insufficient to fuel the thriving, scaled-up life sciences community we aim to achieve by 2035.

We need to develop a broader skills base, rather than relying so heavily on pretrained individuals from AstraZeneca or GlaxoSmithKline and their antecedents. It requires a range of diverse UK businesses across which individuals can build satisfying, successful careers.

The UK market is among the top in Europe – alongside Switzerland – for biotech talent, including experienced managers and entrepreneurs. The stream of people from Big Pharma is a part of that.

What action should be taken?

We must continue to support and expand the multiple UK talent-nurturing programs already in place. These include the BIA’s #BIGIMPACT campaign to attract data science graduates, the PULSE program for aspiring entrepreneurs, TechBio Boost for mentoring early-stage bioinformatics startups and leaders and the emerging Science and Technology Venture Capital Fellowship scheme for up-and-coming investors. The BIA will continue to drive such initiatives, and to support greater diversity and inclusion through initiatives like Women in Biotech.

Vision 2035: A broader, more dynamic skills base

In our Vision for 2035, students are taught the appropriate skills to secure and thrive within high-value jobs. There are no walls between business and academia: education providers, working with industry, offer a range of industrytailored courses. University, government and industry leaders coordinate the delivery of skilled talent to our sector. Hiring great people in the UK is easy.

Our skills base in 2035 will be deeper and broader, equipping the sector to thrive as new technologies – from AI to CRISPR, robotics or 3D printing – transform life sciences. Scientists, data scientists, clinicians and manufacturing experts are vital. But so are leaders and entrepreneurs to drive and direct those specialists; leaders who combine scientific and commercial savvy. So are investors to fund them, and legal/ regulatory/marketing professionals to support them.

A thriving life sciences ecosystem creates jobs beyond science. For every R&D role, there will be a business development and marketing role. As the biotech sector matures from academic spin-out into an industry, the jobs and skills will broaden and diverge.

Yet more can be done to raise awareness of the range of opportunities within biotech among the tens of thousands of graduates emerging each year from our world-leading universities. Not only the 60,000 or so life sciences graduates but also the thousands more with freshly-minted skills across marketing, finance, communications and business – all required for a thriving biotech sector.

Our sector must partner more proactively with UK educational institutes to develop homegrown talent from all regions and backgrounds to fill new positions emerging from and driving our growing success. We must also keep an eye on future skills requirements as these emerge, ensuring they are built into the curriculum and into industry placements as soon as possible. The speed of scientific and technological progress requires greater flexibility in adapting educational programs and the academic-industry interface to maximise talent development.

Biotech competes for talent with other cutting-edge sectors like technology, fintech or edtech. Many offer flexible roles that allow and encourage work-life balance, travel, and that accommodate other personal responsibilities such as caring for children or the elderly. The life sciences workforce must create and promote similarly attractive jobs, appealing to twenty-somethings and to seventy-somethings as well.

Bridging the skills gap in UK biotech

The BIA is actively working to address the projected shortfall of 133,000 skilled workers in the UK life sciences sector by 2030. The initiatives focus on developing homegrown talent, attracting international expertise, and fostering a diverse and inclusive workforce. Key programs and achievements include:

Mentoring and leadership development

Diversity, Equity, and Inclusion (DEI)

Skills development and training

Talent pipeline development

Impact and resources

Building UK talent is just one part of the solution. We must also look overseas: the UK life sciences sector is more reliant on overseas workers than other segments, according to the OLS survey, with over 30% of professional life sciences roles filled by non-UK workers.

Post-Brexit immigration challenges require radical new policies, such as fiscal schemes to re-attract UK-born experts who have pursued life science careers abroad. Belgium, Denmark and Italy are among nations to have already introduced tax breaks for returnees – following China’s “sea turtle” program that has so effectively lured US- and UK-educated Chinese citizens back home. Returning UK-born professionals bring invaluable experience, networks and perspectives to help build next-generation talent, including future leaders.

Changes happen faster with an even more international talent base and wider range of views. It also leads to cross-pollination of ideas.

A more diverse talent base could catalyse more rapid change and bring to the UK some of the best ideas from abroad.

The UK’s talent pool is already core to our international appeal. But we must deepen and broaden that pool. A skilled, productive talent ecosystem is one of the most compelling reasons to start and grow a business in the UK.

The table below summarises concrete steps toward expanding UK skills and building the next generations of life science leaders, operators, regulators, investors and entrepreneurs.

Women in Biotech 2023 and 2024

Reinforce and promote UK strengths

Reinforce and promote UK strengths

More vociferously promoting existing UK strengths, such as health data, dynamic tech and biotech start-up hubs, regulatory and legal expertise and specialist manufacturing

Doubling down on what UK biotech already does well – and has commercial potential – will help build a more sustainable competitive advantage, boosting our prominence on the global stage and attracting further investment, talent and innovation.

The UK already leads in multiple fields. We occupy top spots in regulatory, legal and financial services, trial capabilities and academic science, as well as in advanced therapeutics R&D and manufacturing. Our biopharmaceutical service and supply sector, underpinned by contract research and contract development and manufacturing organisations (CROs and CDMOs) provides essential R&D and manufacturing activities.

UK life sciences boasts two further superpowers: health data and a thriving AI sector. These are the drivers of tomorrow’s more targeted, effective and convenient healthcare solutions. Their combination and convergence within our shores offers even greater opportunity for the UK to stand out from its peers. AI-enabled life sciences – across healthcare, as well as agriculture, materials science, industrial production, climate change and more – will turbo-charge UK growth, output and attractiveness to overseas talent.

TechBio UK 2023 Start-up Festival 2023

Our health data includes the NHS nationwide clinical and outcomes data, genomics, and specialist sources such as UK Biobank’s whole genome sequencing, lifestyle and biological data from half a million citizens. National research projects such as Our Future Health are creating further unique datasets for studying health and disease. (As of January 2025, OFH had recruited over 2 million of the projected 5 million participants across the country.)

The UK life sciences ecosystem is built upon key pillars that differentiate it on the world stage:

- Genomics and data-driven innovation: The UK has established itself as a global leader in genomics, underpinned by world-renowned institutions such as the Wellcome Sanger Institute and Genomics England. These institutions, coupled with a dynamic commercial genomics sector that attracts significant investment, have propelled the UK to the forefront of genomic research and its translation into clinical applications. This expertise seamlessly integrates with the rapidly evolving field of TechBio, where the UK’s rich data assets, including the UK Biobank, converge with its strong capabilities in artificial intelligence. This synergy creates a powerful engine for innovation in personalised medicine, drug discovery, and diagnostics, positioning the UK to lead the charge in data-driven healthcare.

- Advanced therapies and biomanufacturing: The UK has a vibrant CRO/CDMO community and is also a leader in research, development and manufacturing of complex and innovative medicines. This includes pioneering work in cell and gene therapies, enabled by close collaboration between academia, industry, government, and the NHS. (Global supply of Autolus’ newly approved CAR-T cell therapy Aucatzyl will come from a specialist manufacturing site in Stevenage.) Rapid scaling of mRNA manufacturing capabilities since the COVID-19 pandemic further demonstrated UK biomanufacturing strengths.

- Engineering biology and Deep Biotech: The UK is a global hub for engineering biology (the application of engineering principles to biological systems) and Deep Biotech (the non-health applications of biotechnology, including across climate change, industrial manufacturing, pollution and food security.) These capabilities attract substantial private investment and have nurtured a vibrant start-up and SME landscape. Biotechnological tools and approaches hold immense potential to revolutionise sectors beyond healthcare, from agriculture to materials science and energy production.

- A supportive and collaborative eco-system: These scientific and technological strengths are amplified by a highly networked ecosystem and ongoing efforts to promote collaboration and knowledge exchange between academia, industry, and government. UK life sciences are also supported by a strong CRO/CDMO sector and a world-class regulatory framework overseen by the MHRA, which is committed to science-led regulatory innovation and to international cooperation.

To ensure the UK remains globally recognised as the best in these domains, we must reinforce these strengths and ensure they remain UK-rooted, as well as promote them more vociferously, and in a regionally appropriate manner.

Still greater collaboration, faster transfer of skills and ideas between tech/AI and biotech, and more incentives for life sciences firms to use UK-based R&D and manufacturing services (CROs and CDMOs) are needed to secure and grow the UK’s standing into the next decade and beyond.

We must also extract more value from our health data. Despite bright spots such as OFH and the Covid-19 RECOVERY trial, we are not fully leveraging this resource.

The UK has a treasure of health data. We need to make more of it.

One reason for this is that our ‘national’ health data in fact remains fragmented, sitting across a range of systems and servers. (The government’s 2020 “Digital Transformation in the NHS” report found slower-thanexpected progress over the prior six years due to under-investment, fragmented systems and moving goalposts.) Professor Cathie Sudlow’s UK health data review published in November 2024, “Uniting the UK’s Health Data: A Huge Opportunity for Society”, rightly recommends greater coordination among NHS Trusts and other bodies that hold health data. NHS England’s adoption of FHIR (Fast Healthcare Interoperability Resources), the global standard for sharing healthcare data across systems), is welcome, but long overdue.

Regional success

Our connectedness is a core advantage, but UK regions offer different resources. We must recognise and build on these differences to secure future success. Teeside, for example, with its deepwater port, electricity grid and HGV-friendly infrastructure, is a proven cost-effective location for large factories with air handling and clean rooms. Cambridge or Oxford offer outsanding academic and start-up/spin-out eco-systems. The latter will drive the rapid innovation that differentiates the UK; the former is where we harvest the economic fruits of that innovation and build industrial scale.

Policies tailored to each region’s strengths – be they railway hubs, sugar beet fields and ports, or investors, international airports and high-ranked universities – are vitally important to our sector’s growth and competitiveness.

Collaborate more: NHS-industry, UK-UK and UK-international

Collaborate more: NHS-industry, UK-UK and UK-international

Fostering greater collaboration among stakeholders at home and abroad

Greater collaboration and a global outlook is the fourth pillar underpinning our Vision 2035.

UK biotech is already well networked, with its geographically concentrated science, companies, clusters and support services. It is not perfect – transport links between Oxford and Cambridge leave a lot to be desired – but we have shown what is possible when industry, the NHS and clinicians join forces. The UK-initiated RECOVERY study of COVID-19 treatments changed the course of the pandemic and has since expanded into an international pneumonia trial with almost 50,000 participants across close to 180 sites by the end of November 2024.

We have not maintained this collaborative momentum, however. Failure to capitalise on the UK’s unique health infrastructure and data resources will undermine our growth and global status. So, ultimately, will an end-market that appears unwilling to pay for innovation. The UK will never be a large pharmaceutical market, but it is currently also perceived as one of the toughest.

Starting a trial in the UK is extremely slow and bureaucratic. There’s too much red tape and no sense of urgency. That’s a huge miss for the UK, and, more importantly, for patients. If we’d tried to start our trials in the UK only, we’d have run out of money by now. Instead, we’re running our [gene therapy] trials in Poland and the Netherlands.

What can be done?

Greater dialogue and collaboration between industry, the NHS and the National Institute of Care Excellence (NICE) could help address the commercial/access challenges. For example, we could develop creative access deals for newly approved products, provide free-of-charge standard-of-care (SOC) drugs for trial sponsors, or offer easier access to genomic sequencing and clinical data.

Process improvements around clinical trial approvals, such as enabling site contracting and ethics approvals to occur in parallel, is part of the solution.

For the Department of Health to contribute to the UK’s economic growth goals it needs to be strategically interested in growing life science UK scale-ups and their product development. The industry is keen to offer innovation that can deliver better outcomes across medicines, diagnostics, and care delivery tools.

The government’s November 2024 deal with sequencing firm Oxford Nanopore is an example of the kind of collaboration that is possible – and that we need more of. Oxford Nanopore’s fast, efficient sequencing technology will be used on patients with suspected respiratory infections at up to 30 NHS sites, enabling rapid diagnosis within 6 hours and providing an earlywarning system for potential bacterial or viral disease outbreaks. Such deals may be further encouraged, for example, through government-backed incentives for companies that help address specific NHS challenges.

Outside of pandemics, better diagnostics and more effective disease prevention is a core axis – along with more personalised medicine – of sustainable healthcare as populations age. The UK’s health data treasury and innovation base make that possible.

Deals like that between Oxford Nanopore and the UK government better serve patients and the NHS, and the benefit industry and investors. Doing good and making money are not mutually exclusive. They can – and should – happen together for sustainable innovation and growth.

BIA Garden Party 2021 BIA Gala Dinner 2015

If we can’t afford to pay for new drugs, why not set up structures to help run clinical studies, such as easier access to genomics data?

Learning from overseas

Understanding other clusters and countries’ strengths and weaknesses should inform our priorities at home and allows us to position UK advantages more effectively.

In the US, life sciences hubs such as Massachusetts or the San Francisco/Bay Area for innovation and start-up action, or New Jersey, North Carolina or Indianapolis for manufacturing, offer important success templates. While we cannot realistically match the US’s advantages in capital supply, scale and access to talent, we may instead look to focused efforts by other follower nations.

Australia, for instance, is reaping the benefits of a decade-long strategy to attract clinical trials using R&D tax incentives, efficient recruitment and approval processes, flexible regulation and enhanced industry-clinical site coordination.

The French government’s strategy to draw insurance and pension funds into highgrowth companies has already attracted $22 billion of additional investment; part two of the program will also include early-stage ventures.

Benelux nations are using strategic investments and tax breaks to build competitive edge in emerging modalities such as radiopharmaceuticals, which requires specialist (isotope) supply, manufacturing, distribution and treatment ecosystems.

Australia – clinical trial hotspot

Over a decade ago the Australian government set about boosting clinical trials in Australia. Tax breaks are the headline: incentives offer refundable tax offsets of 18.5% above corporation tax, resulting in about 43.5% worth of tax breaks on eligible R&D expenditure (EY Beyond Borders). But flexible regulations, streamlined recruitment and consent processes and tighter industryhealth system integration have also played a role; the country increased the number of annual new trial starts from 1,000 to 1,500 (50%) between 2015-2020 and now runs more clinical studies per capita than the UK, France, Germany and even the US.

Learning for UK: maintain/focus R&D tax credits and strengthen industry-NHS ties

France/Germany – drawing private investment into innovation

France’s Tibi 1 (2019) catalysed a $21.6 billion injection of funding from institutional investors into technology (and biotechnology) firms. Tibi 2, launched in 2023, includes early-stage (private) technology and biotech ventures and has attracted a wider range of investors, including corporates and family offices; its funding goal is €10 billion. The initiative aims to boost both the un-listed and listed technology company eco-systems. Meanwhile, France’s Healthcare Innovation 2030 plan, announced in 2021, outlines €7 billion of strategic investments over 10 years to build biomedical centres of excellence and clinical trial infrastructure, expand digital health and generally increase France’s attractiveness for healthcare innovators (including via its R&D tax credit scheme).

Germany’s Future Fund – Zukunftsfonds (€10 billion over ten years) government is anchor investor in fund-of-funds that allows/ encourages insurers to put more money to work in high-growth fields. The German government also directly invests €100s of millions each year in funds that invest in Germany – not just German-based funds.

Learning for UK: government initiatives can work but require substantial funding and long-term commitment

Benelux – focused attractions

Tax incentives for R&D and manufacturing. Regional funding, local support services and – especially in Walloon region, employment tax incentives. There are also focused efforts to build specialist eco-systems e.g. around radiopharmaceuticals.

The UK’s uniquely concentrated eco-system and strengths allows it to offer excellent selected services and specialties. As biomedicine becomes more complex, with more modalities and technologies in play, focusing on specific areas of expertise, infrastructure and resources will make the UK an even more valuable global player.

Learning for the UK: it pays to focus, especially as modalities multiply and technologies become more complex

Denmark – collaborate to compete

Denmark in 2021 set up a Life Sciences Council to align the objectives of its entire life sciences sector – from pharma and medtech to all of biotechnology. The focus is on building tighter collaboration among companies, academic institutions and the public sector, and on addressing global challenges such as unmet health needs and the green transition. This approach, marked by concrete, measurable goals, empowers a small country to maximise its innovation output and punch above its weight on the global stage (helped, undoubtedly, by the tens of billions of dollars coming in from local pharma firm Novo Nordisk’s Ozempic/ Wegovy franchise).

Learning for the UK: tighter collaboration at home maximises impact abroad

By collectively taking impactful, measurable actions to achieve these goals, we will ensure that they reinforce each other: more capital will attract more talent, both those will generate increased global recognition, and that enhanced standing will in turn mean greater opportunities – and need – for domestic and international collaboration.

Biotech growth engines

Biotechs are the innovation and growth engine driving the broader biopharmaceutical sector. They contribute over two-thirds of the global industry R&D pipeline and are behind the growth in clinical trial starts over the last decade, according to IQVIA. A record 65% of new US drug approvals in 2024 had biotech sponsors, up from less than half a decade earlier.

As large pharmaceutical companies continue to scale back trial activity and streamline in-house R&D, biotechs’ role will grow yet more important, boosting further the growth opportunity for key life sciences nations such as the UK.

Scaling biotechs – like scale-up companies across all sectors – are crucial economic drivers. Firms showing over 20% per annum growth in employee numbers and turnover – the definition used by the ScaleUp Institute, of which the BIA was a founder member – currently make up less than 1% of all small and medium-sized enterprises (SMEs) yet generate half of all SME turnover output.

These fast-growing companies turn technologies into products and services, provide a growing source of new highquality jobs, and fuel a vibrant innovation ecosystem. Yet they also rely on a vibrant start-up eco-system and have specific capital, people and place requirements. UK life sciences will continue to require and support a diverse community of multinationals, universities, charities, small- and mid-sized businesses and service providers.

To achieve the rapid growth required to remain globally competitive, and to anchor biotechnology’s output and benefits within the UK, we must focus heavily on meeting the needs of scaling businesses. This is the segment most let down by our UK life sciences investment community. Yet it is vital for breakout economic growth.

WuXi Healthcare Forum 2019 and BIA Summer Party 2024

Imagine 2035

Imagine 2035 – the long view

Sixty years separated James Watt’s perfection of the steam engine and the public’s first train travel experience on the Stockton and Darlington Railway in 1825. Twenty-five years elapsed between the first fully electronic computer and personalised computers becoming available in people’s homes in the early 1970s. Only 15 years separated the first functional protein produced by genetic engineering and widespread availability of a medicine – recombinant insulin – derived using the same techniques.

Further iterations of those innovations have since transformed society and the world we live in, in ways no-one imagined.

The emergence of biotechnology in the 1980s – with the first recombinant protein medicines, followed by antibodies, cell and gene therapies and other modalities – has transformed the standard of care and saved countless lives.

We are now seeing these biotechnologies transform other industries, from farming to travel to fashion. And just as no-one travelling on that first train in 1835 could have understood the impact that the railway network would have on Britain and the world a generation later, few of us today can probably imagine how biotechnology will have changed our world by 2035.

But let us have a go. An important part of our Vision 2035 is to let our imagination loose on what our sector and its technology can do…

Sophie wakes up. As it is the third day of the month folk around the country are submitting their monthly mouth swab samples from home by drone to the virtual heath service, an arm of the NHS which constantly monitors the nation for signs of disease. Later this week she will receive the all-clear, and can opt to share her data with the virtual VHS – which almost everyone does now that you can do it from home. (A few people chose to use the private option, as the reads are sharper, but you have to use a clunky toothbrush.) Sophie can analyse much of her data herself over time, and request an AI GP appointment if anything concerns her. Since medicines are now designed and dosed personally, they are more effective and less toxic, leaving human GPs more time to attend to patients’ remaining needs (and to train their AI avatars).

After checking on her son Kevin – born last year with an ultra-rare genetic disease which was detected through the nationwide whole genome sequencing programme and successfully cured with an NHS-provided CRISPR gene therapy – Sophie calls her sister Maureen, an aspiring bioscientist. Maureen was inspired by a primary school history module on The Great 21st Century Pandemic and its heroes - Kate Bingham and Sarah Gilbert. She is also excited about the range of career opportunities available to her, and already has an apprenticeship lined up at a biotech company. This means she can develop her skills in a realworld environment but need not give up her other dream of skateboarding for Britain at the forthcoming virtual Olympics.

On her way to work, Sophie passes one of the country’s dozen or so flexible Rapid Response Vaccine Manufacturing Centres, repurposed (given the rarity of pandemic outbreaks) to producing water biopurification systems for remote and less developed parts of the world let down by traditional engineering technologies. She listens to a debate about a recent infectious disease that was nipped in the bud with zero harm done: was this thanks to the new generation of fast-acting antimicrobial drugs, or changed antibiotic prescribing patterns? One of the contributors is Paddington Bear, the AI-generated spokesbear for Paddington PLC, an Imperial College spin-out that is now the largest company on the UK FTSEtech index.

Sophie reaches her workplace: a microbiome business run largely by AI agents, who responsibly share data with the VHS and carry out around-the-clock sequence sampling. They are close to identifying gut microbe combinations and gut-brain interactions that protect against neuro-degenerative disorders. Sophie is really excited. She suspects that her start-up, BugBrain – generously funded by UK investors – has provided further inspiration for Maureen. At lunch, she tucks in to a cultivated meat burger and later returns home in her algae-fuelled tricopter.

Now take a moment to imagine your day in 2035

- What does the UK life sciences sector look like?

- How have technologies, companies, or research that exist today evolved to transform lives, industries, and the NHS?

- What role have BIA companies played in enabling this success?

Share your vision for UK life sciences – #LifeSciencesVision2035

Conclusion

UK biotech is maturing and maintains a strong global ranking. But we cannot be complacent. Without focused efforts to boost late-stage capital and grow our commercial footprint alongside our scientific one, we will lose out. As competitor life science economies grow, the UK must double down on its strengths and collaborate to retain its global reputation. At home, our priority is to address the lack of late-stage capital and of scaled-up companies that allow others to harvest the juiciest fruits of UK creativity. Abroad, we must more vociferously promote UK strengths, work with partners and make greater efforts to pull UK life sciences experts back home, as well as attract international talent.

This sector benefits from superb science, consistent government backing and growing involvement from deep-pocketed tech investors and talent as disciplines merge. Our regulatory flexibility has yet to be fully exploited.

Instead of trying to directly re-create Boston and the US Nasdaq, we will build on unique UK strengths in a stepwise, measurable fashion to drive greater growth, investment and global prominence. Doing so will ensure that the value of the UK life science sector in 2035 reflects more fully its extraordinary scientific/academic excellence and – most importantly – that the sector delivers products and services to improve global health.

I get it – so what can I do?

Industry

- Promote UK strengths and assets at home and abroad

- Encourage international employee exchange programs • Liaise with UK universities to help tailor courses & offer work placements

- Collaborate with NHS/clinicians by demonstrating the value that such partnerships can bring

- Invest in the UK

- Engage creatively with NICE/NHS to provide early access to new drugs

- Leverage UK policy incentives to invest in the UK (e.g. bioinnovation hubs like Lilly Gateway Labs; manufacturing hubs).

- Specialists: Engage with/ support pension fund managers in their shift toward private/unlisted assets

- Support UK companies for longer, including by syndication; encourage local infrastructure (even for US-listed firms)

- Engage with overseas investors on UK strengths and investment opportunities

- Generalists: Engage with specialists to fully understand the risk-return profile of life sciences investments

- Hire/build specialist expertise and engage with / act on pension reform initiatives to accelerate investments into private entities

-

Maintain and grow efforts to funnel pension fund capital into private sector assets including life sciences

- Take action to integrate and facilitate access to UK Health data (per Sudlow report), including by UK-based companies

- Guarantee R&D tax credit, Enterprise Investment Scheme (EIS) and Patent Box

- Engage in more creative deals to accelerate access to medicines

- Support clinical trial growth through policies such as subsidised access to SOC drugs.

-

Trust that the industry wants better health outcomes too

-

Accept that profit is not always bad, especially as government funding is constrained

-

Collaborate with industry: it has a lot to offer

-

Streamline clinical trial set-up and execution processes including through closer coordination with ethics committees and trial sites/hospitals

-

Offer patients new options

-

Engage in population-wide health data initiatives like the Health For All study

-

Support researchers by consenting to share health data

-

Participate in relevant clinical trials

-

Get your kids interested in life sciences.

Editors’ note

It is impossible to successfully synthesise all of the great comments and discussions into one document, but I hope we have managed to reflect many of the pressing concerns into a coherent way forward. Apologies to those who suggested themes or ideas we have not been able to include. With particular thanks to Melanie Senior, Saqib Lal, Wendy Quainoo and Christopher Ball who have been the driving forces in making this a reality. Many thanks to the BIA Board (past and present), Committee members and Chairs, to all BIA staff as well as members and industry professionals for their time, ideas and feedback.